SCVBA* Annual Report

Fiscal Year 2023-2024 Summary

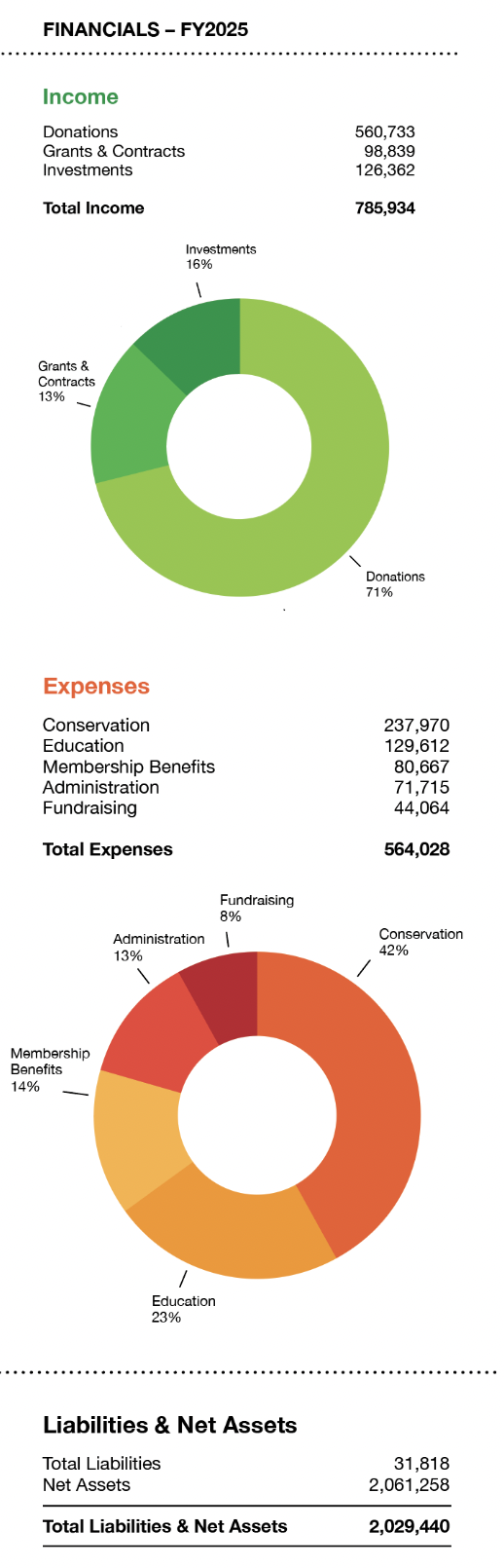

NOTES ON FISCAL YEAR 2025

Expenses Table 2024-2025

The Santa Clara Valley Bird Alliance (SCVBA), formerly known as the Santa Clara Valley Audubon Society ended its Fiscal Year 2025 (June 1, 2024 to May 31, 2025) with an Operating Surplus of $189,784 before taking into consideration net gains in the organization’s investment portfolio. Including unrealized net gains of $32,122, we ended the year with an increase in Net Assets of $221,906.

When compared to the prior fiscal year, Revenue from Donations was up an impressive 84% to $560,733. This increase included a one-time donation of $150,000 during the annual appeal. Additionally, we were excited by the success of our Spring Birdathon, which in 2025 raised a record $91,434. Revenue from Grants & Contracts was up by 5.5%.

Total Operating Expenses increased nearly 10% compared to the prior year. Our ratio of program expenditures to Total Expenses decreased from 87% in 2024 to 79% in 2025, due primarily to increased expenses in fundraising and investment management of the Legacy Investment Portfolio.

Our Balance Sheet continues to be strong with $2.0 million in Net Assets at May 31, 2025, an increase of 13% from the balance at May 31, 2024 due to the net gains in the investment portfolio as well as the operating surplus.

We are fortunate to have been able to create and grow our legacy investment portfolio ($1.7 million as of May 31, 2025) over many years. That portfolio was put into place to meet future environmental challenges and undertake new educational and conservation initiatives. We target to utilize 2% of that portfolio for those purposes each year. It is not intended to be used for operating purposes.

One of our financial goals is to generate positive Operating Income on an annual basis while funding healthy, effective and growing programs supporting our Mission. In some years, including in 2025, we have been fortunate to have received sizeable one-time donations to help us achieve positive Operating Income. While we are extremely grateful for these donations, we believe that it would be prudent to establish fundraising strategies and to dedicate additional resources towards development and fundraising. Enhancing our fundraising capabilities will be critical to maintaining and enhancing our programs. To that end, we ask you to consider making a donation to the SCVBA if you have not yet done so, or to consider increasing the amount that you donate so that we can continue to offer the robust programs that we do year in and year out. We thank you.

I would like to make two additional asks of you:

1. The organization derives most of its funding from individual donations from memberships, fundraising campaigns (as above), fees for birding classes, and a few grants and corporate donations. We are working to increase our sources of revenue and we ask you to suggest additional sources of revenue for the organization to pursue.

2. We are always looking for new Board members and have a particular need for Board members who have a financial background. Please contact our Executive Director, Matthew Dodder, director@scvbirdalliance.org or myself, Craig Hunter, if you have an interest or please refer us to someone who may have an interest. The solution to improving our financial situation not only requires additional funding but also additional volunteers to support all of our efforts.

Santa Clara Valley Bird Alliance is headquartered in Cupertino, CA, has an Employer Identification Number (EIN) of 94-6081420, and is an Internal Revenue Code Section 501(c)(3) organization. Donations generally qualify as charitable deductions for federal income tax purposes. Please consult with a tax professional to determine the extent to which your contributions are deductible. SCVBA is classified by the IRS as a Charitable Organization with a ruling year of 1977. (Source: IRS Master Business File and Form 990)

Signed,

J. Craig Hunter, Treasurer

-

Santa Clara Valley Bird Alliance (SCVBA), formerly known as Santa Clara Valley Audubon Society (SCVAS) ended the 2022 – 2023 fiscal year (June 1, 2022 to May 31, 2023) with a realized profit of $61,816 before taking into consideration unrealized gains on the organization’s investment portfolio. Financial markets continue to recover from the 2022 “bear market” and we too saw the value of our investment portfolio increase over the course of our fiscal year. We continually monitor our portfolio and make adjustments as necessary to the asset allocation. We believe our portfolio is well-balanced overall and conservative. Including the unrealized gains of $10,682, we ended the year with an increase in net assets of $72,498. When compared to the prior fiscal year, revenue from Donations was up by 20% and revenue from Grants & Contracts was up by 4%. Total Operating Expenses increased by 6% when compared to the prior fiscal year. Our ratio of program expenditures to total spending was 87% for the year, unchanged from the prior year. The organization continues to be very focused on devoting its resources to programs. Fundraising expense was 4% for the year, unchanged from the prior year. Our Balance Sheet continues to be strong with $1.7 million in Total Equity at May 31, 2023, an increase of 5% from the balance in Total Equity at May 31, 2022 due to both the positive profit and the unrealized gains in the investment portfolio.

Santa Clara Valley Bird Alliance is headquartered in Cupertino, CA, has an Employer Identification Number (EIN) of 94-6081420, and is an Internal Revenue Code Section 501(c)(3) organization. Donations generally qualify as charitable deductions for federal income tax purposes. Please consult with a tax professional to determine the extent to which your contributions are deductible. SCVBA is classified by the IRS as a Charitable Organization with a ruling year of 1977. (Source: IRS Master Business File and Form 990)

-

The Santa Clara Valley Bird Alliance (SCVBA), formerly known as the Santa Clara Valley Audubon Society ended its Fiscal Year 2024 (June 1, 2023 to May 31, 2024) with an Operating Deficit of $71,939 before taking into consideration net gains in the organization’s investment portfolio. Including realized and unrealized net gains of $211,238, we ended the year with an increase in Net Assets of $139,299.

When compared to the prior fiscal year, Revenue from Donations was up by 8% due to stronger response to our three primary fundraising campaigns focused on Advocacy, Birdathon, and Annual Appeal (for which we are grateful). Revenue from Grants & Contracts was down by 34% due primarily to a major one-time Grant made in our Fiscal Year 2023 that was not repeated in our Fiscal Year 2024. Total Operating Expenses remained essentially flat compared to the prior fiscal year. Our ratio of program expenditures to Total Expenses was 87% for the year, unchanged from the prior year.

Our Balance Sheet continues to be strong with $1.8 million in Net Assets at May 31, 2024, an increase of 9% from the balance at May 31, 2023 due to the net gains in the investment portfolio.

We are fortunate to have been able to create and grow our legacy investment portfolio ($1.5 million as of May 31, 2024) over many years. That portfolio was put into place to meet future environmental challenges and undertake new educational and conservation initiatives. We target to utilize 2% of that portfolio for those purposes each year. It is not intended to be used for operating purposes.

One of our financial goals is to generate positive Operating Income on an annual basis; however, this has been a challenge in most years. In some years we have been fortunate to have received sizeable one-time donations to help us achieve positive Operating Income. That did not occur in FY 2024 and thus we are showing an Operating Deficit. To address the challenge, the organization has embarked on a program to enhance our fundraising capabilities. That is critical to being able to maintain and enhance our programs. To that end, we ask you to consider making a donation to the SCVBA if you have not yet done so or to consider increasing the amount that you donate so that we can continue to offer the robust programs that we do year in and year out. We thank you.

I would like to make two additional asks of you:

1. The organization derives most of its funding from individual donations from memberships, fundraising campaigns (as above), fees for birding classes, and a few grants and corporate donations. We are working to increase our sources of revenue and we ask you to suggest additional sources of revenue for the organization to pursue.

2. We are always looking for new Board members and have a particular need for Board members who have a financial background. Please contact our Executive Director, Matthew Dodder, director@scvbirdalliance.org or myself, Gary Campanella, if you have an interest or please refer us to someone who may have an interest. The solution to improving our financial situation not only requires additional funding but also additional volunteers to support all of our efforts.

Santa Clara Valley Bird Alliance is headquartered in Cupertino, CA, has an Employer Identification Number (EIN) of 94-6081420, and is an Internal Revenue Code Section 501(c)(3) organization. Donations generally qualify as charitable deductions for federal income tax purposes. Please consult with a tax professional to determine the extent to which your contributions are deductible. SCVBA is classified by the IRS as a Charitable Organization with a ruling year of 1977. (Source: IRS Master Business File and Form 990)

IRS Forms 990

2025 Form 990 (6/1/2024 to 5/31/2025)

2023 DRAFT Form 990 (6/1/2022 to 5/31/2023)

2022 Form 990 (6/1/2021 to 5/31/2022)

2021 Form 990 (6/1/2020 to 5/31/2021)

2020 Form 990 (6/1/2019 to 5/31/2020)

2019 Form 990 (6/1/2018 to 5/31/2019)

2018 Form 990 (6/1/2017 to 5/31/2018)

2017 Form 990 (6/1/2016 to 5/31/2017)

2016 Form 990 (6/1/2015 to 5/31/2016)

2015 Form 990 (6/1/2014 to 5/31/2015)

2014 Form 990 (6/1/2013 to 5/31/2014)

2013 Form 990 (6/1/2012 to 5/31/2013)

2012 Form 990 (6/1/2011 to 5/31/2012)

2011 Form 990 (6/1/2010 to 5/31/2011)

2010 Form 990 (6/1/2009 to 5/31/2010)

2009 Form 990 (6/1/2008 to 5/31/2009)

2008 Form 990 (6/1/2007 to 5/31/2008)

2007 Form 990 (6/1/2006 to 5/31/2007)

2006 Form 990 (6/1/2005 to 5/31/2006)

2005 Form 990 (6/1/2004 to 5/31/2005)

2004 Form 990 (6/1/2003 to 5/31/2004)

2003 Form 990 (6/1/2002 to 5/31/2003)

2002 Form 990 (6/1/2001 to 5/31/2002)

2001 Form 990 (6/1/2000 to 5/31/2001)

2000?

1999?

1998 Form 990 (6/1/1997 to 5/31/1998)

Additional Information

*The Santa Clara Valley Bird Alliance (SCVBA) was formerly known as the Santa Clara Valley Audubon Society (SCVAS).

Banner Photo Credit: Wilson’s Phalaropes by Tom Grey